As Bitcoin prices boom, so-called experts are crawling out of the woodwork, offering us their expertise to educate us from being Crypto-confused to Crypto-savvy.

They claim that they’ll teach us how to make Bitcoin our new income stream, urging us to attend their webinars, free events, workshops and Bitcoin Bootcamps. Yet, only a year ago many of these Cryptocurrency experts and self-proclaimed Crypto-nerds were property marketers or computer programmers.

Unlike the new wave of these crypto-experts, Cryptocurrencies have been around since 1996 and the earliest, such as Beenz, e-Gold and Rand are long gone. In the last ten years their number has escalated so we have Litecoin, Swiftcoin, Namecoin, Bytecoin, Dogecoin, Feathercoin, Emercoin, Gridcoin, Primecoin, Auroracoin, Mazacoin, Blackcoin, Titcoin, Vertcoin and Burstcoin; at last count, over 47 varieties of altcoins, or cryptocurrencies to choose from.

While that should already sound warning alarms, there’s a far bigger issue at play here, which is the risk for investors when booms turn into bubbles. While booms may be founded on genuine demand, bubbles are fuelled by speculative buying frenzies which have nothing to do with the underlying utility value of the asset being purchased. They only last while more and more investors are lured in by the apparent certainty of massive financial gains and they can end without warning.

EXPONENTIAL GROWTH FED BY SPECULATION ENDS BADLY

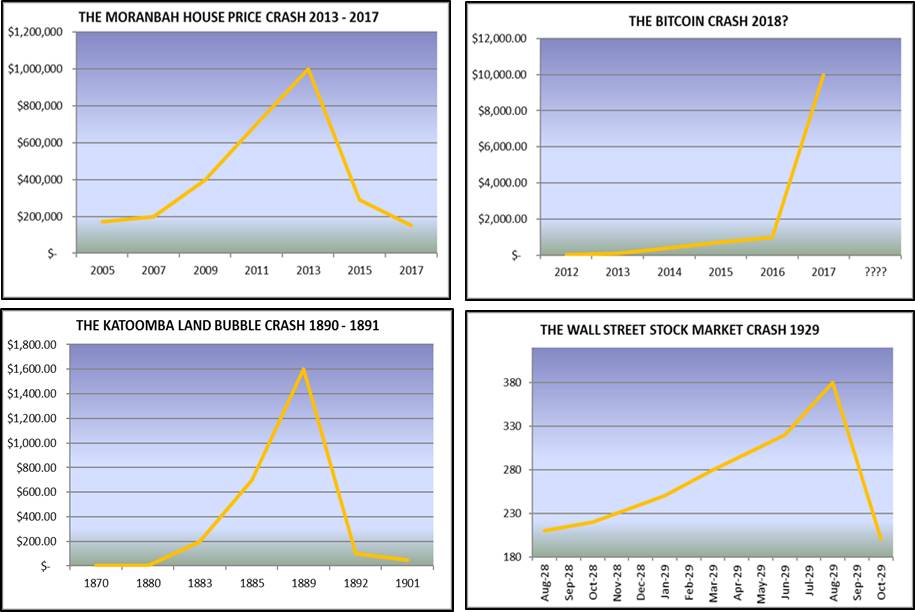

There are many examples of booms turning into speculative bubbles, such as the Katoomba land boom which ended in disaster for thousands of mum and dad investors in 1890, the Wall Street stock market crash of 1929 which wiped out billions of investor funds in a few days, and more recently the mining house market crash in towns such as Moranbah which financially ruined many property investors.

The graphs showing these price crashes all look the same, with escalating demand and rising prices turning into a speculative buying bubble as more and more investors get sucked in. Then the bubble suddenly bursts and prices crash to levels lower than they were before prices starting rising. Whether it’s land, houses, shares or any other tradeable commodity like Bitcoin, the lesson is that exponential price growth fed by pure speculation without underlying utility value often ends in disaster.

BITCOIN HAS GREAT INVESTMENT RISKS

Assets have value because they provide cash flow or capital growth and sometimes both. Housing, for example, delivers cash flow from rent and can also provide growth potential based on genuine demand for accommodation, but the only value that Bitcoin offers comes from pure speculation. This means that the investment risks associated with Bitcoin are even greater than with other commodities.

The other difference between land, housing, shares and Bitcoin bubbles is the speed at which the crash occurs when the bubbles burst. The easier and quicker it is to buy and sell, the greater the volatility and speed at which the fall in prices occurs. When housing bubbles burst, the slide in prices can still take years, but Bitcoin is easily and quickly traded, with a turnaround of only ten minutes and this means that Bitcoin investors could face ruin without any warning.

Bitcoin was developed as a secure and verifiable medium of exchange, designed to work digitally through public transaction databases rather than central banking systems. This honourable aim is now being hijacked by the spruikers to present Bitcoin as a get rich quick opportunity, which it may well be for them, if not for us.

.................................................

John Lindeman is widely respected as one of Australia's leading property market analysts, authors and commentators.

John Lindeman is widely respected as one of Australia's leading property market analysts, authors and commentators.

Visit Lindeman Reports for more information.

He has well over fifteen years’ experience researching the nature and dynamics of the housing market at major data analysts.

John’s monthly column on housing market research featured in Australian Property Investor Magazine for over five years. He is a regular contributor to Your Investment Property Magazine and other property investment publications and e-newsletters such as Kevin Turners Real Estate Talk, Michael Yardney’s Property Update and Alan Kohler’s Eureka Report.

John also authored the landmark books for property investors, Mastering the Australian Housing Market, and Unlocking the Property Market, both published by Wileys.

To read more articles by John Lindeman, click here

Disclaimer: while due care is taken, the viewpoints expressed by contributors do not necessarily reflect the opinions of Your Investment Property.