Property investors are in it to make a profit – but not everyone is ready to deal with the difficulties of handling tenants along the way. Without the right protection and approach, being a landlord can become a nightmare.

The prospect of taking the leap from owner-occupier to property investor is both exciting and terrifying. You’re thrilled about the idea of building a portfolio, securing your family’s financial future or funding your retirement, but also apprehensive about opening yourself up to the well-known risks of investing in real estate.

As with all investments, becoming a landlord can have its pitfalls, but there are some simple strategies you can implement to avoid them.

Being a landlord can be very stressful, as it’s not just a simple matter of sitting back and collecting rent from whoever steps through your door. You also have to source the right tenant, chase up said tenant to make sure they pay up each month, and deal with maintenance, repairs and complaints.

You can hire a property manager to oversee your rentals, but this isn’t a foolproof solution. As a landlord, it’s crucial that you know about the big risks ahead of time so you can protect yourself from any inevitable headaches before they arise.

Common Risks for Landlords

1. Poor tenants

One of the worst things that can happen to a landlord is to let an irresponsible tenant through as a result of inadequate screening. Bad tenants can cause you a number of problems, including property damage (deliberate or accidental), non-payment of rent, and complaints from either the neighbours or the authorities. Some tenants may even turn into pesky squatters, enjoying the comforts of your home without compensating you for it.

2. Broken rules

Irresponsible tenants generally don’t care about any rules you’ve set – they’ll sneak in pets or guests even if you’ve said no, and leave you to clean up the resulting mess. In some cases, longer-term tenants may turn your place into a short-term rental through Airbnb or Stayz without your permission so they can benefit illegally from your investment.

3. Payment problems

This is one of the most serious potential risks for a landlord – not getting paid or getting paid late. Some tenants only cough up the money if they’re being chased for rent, and in some cases they may run off in the middle of the night without a trace. Keep in mind that these cases are the exception, not the rule; most tenants pay their rent regularly and without prompting. However, you should consider what your plan will be if your property income stalls for an extended period.

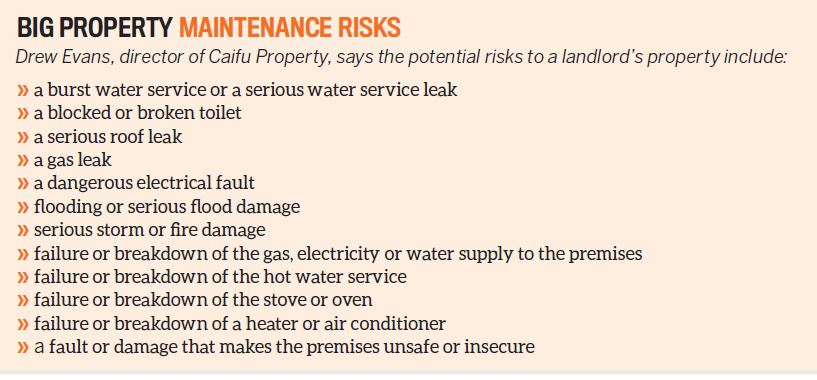

4. Lack of maintenance

You tend to take care of what’s your own, but it’s hard to trust that tenants will do the same. So a property you rent out in excellent condition could end up being a disaster in a few years’ time if you’re not mindful about checking in. When maintenance isn’t kept up regularly, it doesn’t just mean that the furniture, appliances and plumbing will be in poor condition – you could also be looking at major structural or electrical damage from pests like termites or rats.

5. Lazy property managers

Property managers are supposed to make things easier for you, but a poor property manager can just add further complications. If they are slow to respond or difficult to reach, you may be unaware of what’s happening with your property, and your tenants may be left without a contact. Poor managers are also ineffective or unmotivated when it comes to marketing your property to potential tenants, increasing your risk of vacancies and poor tenant placement.

Top 5 Landlord Insurance Claims

1. Loss of rental income

According to Carolyn Parrella of Terri Scheer Insurance, loss of rent comprises more than half of landlord insurance claims.

2. Malicious and accidental damage

Claims can range from smaller repairs to significant clean-ups of damage done to a property.

3. Water damage

This involves damage to a property caused by leaky appliances or faulty plumbing. Note that not all premiums cover tenant-related water damage.

4. Storm damage

Storms are a major cause of damage to property, especially in places like Queensland, which is prone to weather disasters.

5. Tenant death

This is a surprisingly common reason why many landlords lose out on rent.

Avoiding these risks

The aforementioned landlord problems can certainly be hard to handle, but they can be avoided by setting clear standards and taking precautionary action early on:

1. Implement a strict screening process

Don’t be afraid to be very thorough in conducting background checks on potential tenants. Even if they’re not exactly beating down your door, don’t let desperation affect your judgment – ultimately, you run into more trouble by renting to a bad tenant than by waiting for a good one. To avoid delayed payment or non-payment of rent, it’s important to clarify in the leasing agreement when you expect to be paid, and the consequences for missing payments. Treat property rental like the business it is.

2. Hire a good property manager

Find someone who has a strong track record of effectively managing properties in the locality. Check their references and get in touch with their other clients. You can’t expect to get quality service cheap, so don’t seek to penny-pinch on this expense. “Cheap is cheap for a reason. In most cases, if you pay peanuts, you get monkeys. Engage a professional to act on your behalf,” says Drew Evans, head of strategy at Caifu Property.

3. Know how the law protects you

Laws differ across states, but landlords are entitled to certain legal rights in the event of tenant or property manager disputes. These regulations are listed on most state government websites, and being aware of them will put you in a more advantageous position in the event that you need to enforce clauses in the leasing agreement or terminate contracts. However, just because you can take legal action doesn’t always mean you should. “At the end of the day it comes down to being fair and reasonable. If the cost of legal action outweighs the potential loss, then you need to weigh up if it is actually worth it,” Evans advises.

4. Do regular spot checks

It’s often said that if you want something done well, do it yourself. Thus, if you want to make sure that all is well at your property, you need to take time out of your schedule to drop in, preferably unexpected. That way your property manager knows you’re on the ball, and tenants are less likely to be out of line if they know you can show up at any time.

5. Get insurance

There may be damage to your property that you can’t avoid even if great care is taken, so you need to be protected against such costs. “[A comprehensive landlord insurance policy] includes claims for multiple insurable events,” explains Carolyn Parrella, executive manager at Terri Scheer Insurance. Indeed, landlord insurance doesn’t just protect you in the event of property damage – it also softens the financial blow in the event that a tenant skips town and stops paying rent.

Owning an investment property and renting it out can be a risky but rewarding prospect. As long as you don’t walk into the rental market with your eyes closed and expect investing in property to be a ‘set and forget’ prospect, being a landlord can set you up for financial freedom.