12/04/2018

"As soon as they compare houses with dual dwellings, the penny drops and they say they’ll never look at buying a single house again"

A property veteran has staked his reputation on the validity of dual dwellings, saying they’re a safer option for risk-averse investors but also provide an enviable rental income.

Graeme Shiels is the CEO of Property Queensland, which specialises in newly built dual dwellings. While many people remain unaware of this investment option, Shiels is on a mission to change that.

“People come up from Sydney all the time and say, ‘How come we didn’t know about this before? How come everybody isn’t investing in this?’” he says.

Designed to appear from the outside like a standard detached home, the building is actually separated by a commercial-grade soundproof wall to create two independent dwellings.

“That means you’re getting income from two tenants,” says Shiels, who has over 50 years’ experience in the industry. “With a house or any other property, if your tenant moves out you’ve got no income during the vacancy period, whereas with these, if one tenant moves out you’ve still got the income from the other.”

Investors also get the capital appreciation attributed to a house because the two separate living spaces are on a block of land – and “it’s the land that goes up, not the house”, says Shiels.

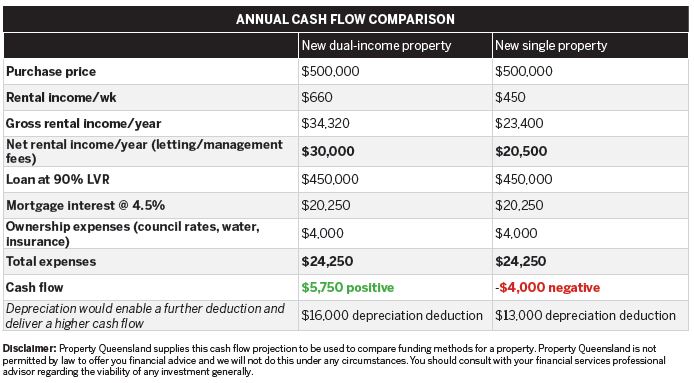

The properties are cash flow positive, so even if an investor were to borrow at a high LVR, they could still expect an excess of income each month rather than a debit.

“It suits people who don’t want to be stuck in slow capital growth times, which always come and go, and it suits those who don’t want to be forced into selling at a less than ideal time because they can’t afford the repayments or the negative payments,” says Shiels.

“I don’t keep office hours. If someone phones me, I’ll take the call as long as I’m not asleep”

“It enables them to keep the properties going.” While some investors are wary of new builds and the unforeseen costs that can accompany a construction project, Shiels says none of his clients have ever paid more than what was initially agreed upon.

“All of the contracts are fixed-price contracts; the land contracts are fixed price and the build contracts are fixed price, and none of our clients have ever paid a dollar over what they’ve signed up for,” he says.

“On the odd occasion the builder or I have paid for any unforeseen things that have happened, but the client has never paid an extra dollar.”

Part of that, of course, comes from working with builders who have a strong track record, and Shiels’ primary building partner has more than 20 years’ experience and has built more than 3,000 properties.

Shiels also invests significant time and resources in identifying the ideal location for a property, which in turn keeps building costs down.

“We get research from all sources on a regular basis – we get them from the government, from all the banks, we get them from private research firms, we get them from everybody, and we put them all together and then go out and look for the land which matches those reports,” he says.

“If you didn’t do that, you could easily end up in an area with poor growth potential, but you could also end up buying the wrong block of land, with the wrong soil,” he continues. “Then when you get the quotes from the builder and he does his soil tests, he might add an extra $20,000 on the bill.”

Investors can also expect a personalised service from this long-term property expert. “I don’t keep office hours.

If someone phones me, I’ll take the call as long as I’m not asleep,” Shiels says. “I think it’s important that investors know they can always be in contact with me, not with some junior salesperson who may or may not know much about investing.”

ABOUT THE EXPERT

Property Queensland specialises in helping investors drive capital growth and high yields through newly built dualincome dwellings.

www.yourproperty.com.au/duals | e. graeme@yourpropertyqld.com.au | p. 0417 725 168.