As a professional investor with around 50 properties in Australia,

Todd Hunter has enjoyed undeniable success on his home turf. But in 2013 he turned his attention further afield and found that there was far greater potential elsewhere – specifically, in America.

Now Hunter also owns close to 30 properties in the United States and he is steering his Sydney-based buyer’s agency, wHeregroup, in the same direction so others can take advantage of the high returns on offer.

“We are focusing 100% on investing in the US at the moment,”

Hunter tells Your Investment Property. “The reason is simple – as a professional investor, I’m always on the hunt for new locations to invest in that I know will deliver great returns through yields and capital growth. From there, I buy property for myself but then also for my clients because there are so many good deals. I simply can’t buy them all, so I might as well capitalise on my own research and buy for clients.”

Hunter – who now splits his time between America and Australia – says his most recent research has identified two US cities that have all the signs of a golden goose property market.

“Sixteen years is a long time, and in that time this is only the second time I have seen a lifechanging property investing opportunity – one that can set you up financially for life,” he says. “I know those words ‘set me up financially for life’ get thrown around a lot in the industry, but I can tell you I am so excited about the US at this time that I am buying, on average, two houses per month myself.”

While Hunter has high hopes for the US property investment opportunity, he says he’s unable to reveal the exact locations of the hotspots due to industry competition.

“Our location has topped the US capital growth locations for the past three years for houses under US$100,000”

“Our location has topped the US capital growth locations for the past three years for houses under US$100,000”

“It may be coincidental, but when I release a new e-book on a past location I have invested in, almost immediately there are several property companies that start buying there,” he says.

“This has happened time and time again – I should take it as a compliment, as they use my research to invest for their clients, but that’s why I don’t release where I’m currently investing until I’ve bought all the best deals for me and my clients.”

That said, Hunter did say he had invested heavily in Detroit in the past, and he recently published an e-book explaining why he chose the region out of 3,144 counties in the US.

“I started buying there six years ago, and in the early days we were getting 21% yields and buying houses for between US$40,000 and US$60,000,” he says.

In addition to the impressive yields, Hunter says the area has seen over 10% capital growth per annum for the last three years in a row.

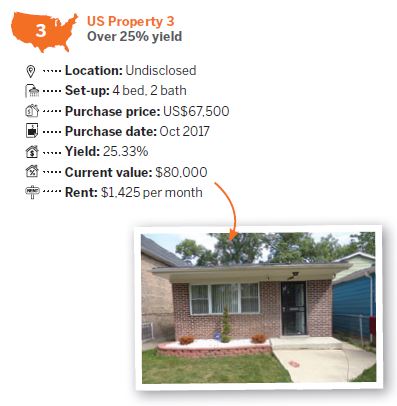

“That’s an ROI of over 30%, and our location has topped the US capital growth locations for the past three years for houses under US$100,000,” he says. “As a result, I have had two of my own houses there double in value.” This success is far from a fluke, and Hunter says one of the undisclosed locations he’s currently focusing on is also enjoying yields of over 20%, while house prices sit in the modest range of US$60,000 to US$80,000.

“It’s not easy – it takes inspecting hundreds of houses to get them, but we are getting them nearly every time,” he says. “We have even had a few houses get over 25% yield.”

Of course, Hunter acknowledges that savvy investors may be reluctant to believe his claims without any proof, so he has also shared his own personal tax return in a video education series he developed.

“You can see that I am netting yields of over 15% and for two houses over 16%,” he says. “I’m pretty sure no other investor has ever done that before, and it’s all backed up with a signed letter from my accountant verifying the numbers are true and correct.”

While investing overseas may seem a stressful endeavour to some, Hunter says it’s actually a fairly simple process and the 18-part education series he developed has been designed specifically to help investors understand everything they need to know before branching out overseas.

While investing overseas may seem a stressful endeavour to some, Hunter says it’s actually a fairly simple process and the 18-part education series he developed has been designed specifically to help investors understand everything they need to know before branching out overseas.

“By the end, any investor could go buy a property in the US on their own – you will have all the tools you need to be successful, except where to buy,” he says.

“That’s my little secret left for me and my clients.”

With such gains to be made in America, Hunter says it’s unlikely he’ll turn his attention back to Australia any time soon.

“I still research Australia every couple of months, and for the past year there’s been nothing that’s excited me,” he says.

“With houses under $100,000 and yields over 20% in the US, it’s going to take a dramatic turn in the market here to make me excited again, that’s for sure.”

To learn more about investing in the United States, readers can access Hunter’s education series at www.wheregroup.com.au