12/04/2018

Property Valuation is a crucial aspect of most transactions. For a potential buyer looking to take out a loan, lenders will require this information prior to determining whether it’s a good idea. A valuation also shows a buyer whether they’re getting an excellent deal or are being misled about a property’s worth.

A dwelling’s market value refers to the property’s value based on its best potential use on a date agreed upon by an informed buyer and a seller. However, it does not include unusual circumstances like off-market sales to a neighbour, transactions between family members, or sales involving distressed sellers. This is because valuation is by nature a clinical, emotionless process. There can be no sentiment involved, which is why even experts in the industry will ask other valuers to look at their property if they feel too attached.

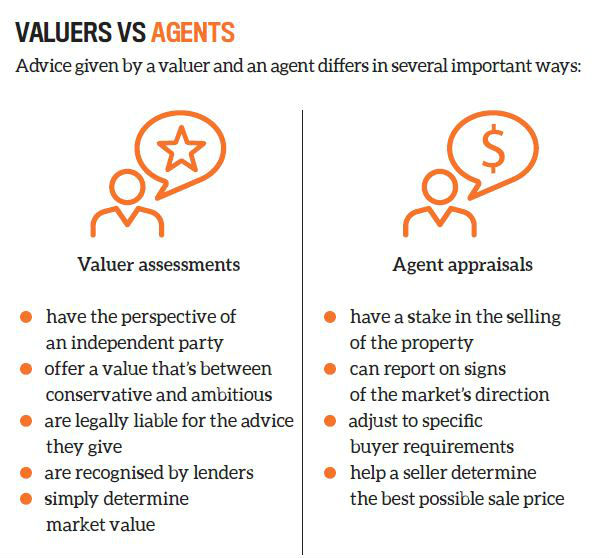

There should also be no shortcuts taken in the valuation process. Valuation takes time because you need to consider multiple sources and do inspections in order to be thorough. Valuers can’t afford to make speculations about the movement of the market as they must be impartial – legally, their assessments bear liabilities.

How does a valuer think?

1. Research the surroundings

Research is at the core of the valuation process. Learn everything you can about the suburb the home is located in by interacting with agents, stopping in at auctions, and comparing the results of property transactions.

Talk to the local government offices as well; look at council records and get information on zonings. Know what the restrictions are where renovation is concerned.

Moreover, consider the area immediately around the property. Does it face a busy road? Does the street have a reputation for criminal activity? Noise levels and lack of security can be a blow to market value, even if the property is generally well located.

2. Inspect Within

Once you know the environment you’re dealing with, it’s time to check out the property for yourself. It’s ideal to look at the home as made up of components rather than as a whole.

If you can measure the dwelling’s dimensions, do so. Evaluate the condition of the place strictly. How will the property stand up against the elements and against usage in its current state?

Then ask yourself: how much of the land is actually usable?

If the home is on a big, sloped block or positioned so that the land cannot be properly maximised, then the space doesn’t add value.

Consider other improvements to the site beyond the main property, such as landscaping and driveways. Do the available facilities overshadow everyone else? Or does the home look underdressed beside the other properties on the street?

The goal is to simply be on par with the neighbours for easy comparison later on. Many property owners fall victim to overcapitalising – putting in facilities that look nice, but that don’t actually add tangible value to the home.

3. Compare with similar properties

Look up transactions in the area involving similar properties to get a good idea of sale prices. Don’t cast too wide a net though – limit your comparison properties to those that are nearby and have facilities like the home in question.

Take a peek at the ‘Sold’ section of your preferred property website and narrow down your search to similar dwellings.

You can also do it manually if convenient – that is, go around the neighbourhood, keep an eye out for sold homes, and talk to agents about similar sales.

Single out at least three dwellings to compare with the property you are valuing. Make sure you look at median-priced properties, not at the outliers. This will help you determine an accurate market value range that’s close to the midpoint. However, don’t consider listing prices, which are never accurate and are almost always eschewed by professional valuers.

4. Use recent data

Endeavour to have the best possible sales evidence to work with when conducting a valuation. Be diligent in looking up current statistics.

The property market can and does change quickly – a negative event can send a booming market spiralling downwards. So, using year-old data, for instance, would be regarded as false sales evidence.

Websites like Real Estate Investar and CoreLogic are great sources for general up-to-date suburb figures. Do also consult local agents, because they’re likely to have the new data on hand.

5. Keep an eye out for the little things

Valuers don’t look at the pomp and blare of a property, so flashy upgrades won’t do much good if the upkeep of the rest of the dwelling is poor. Valuers can typically forgive an unclean yard and a cluttered room, but when there’s too much mess and disrepair, it can influence the upper half of the value range.

A fresh paint job and a thorough cleaning can be adequate. Replace old fixtures, especially in the kitchen and bathroom, because valuers pay particular attention to these areas. Lovely presentation can help drive a good valuation, because for a buyer it shows that’s there’s little that needs to be done with the property

(therefore expenses are limited) before moving in.

6. Be realistic

Ask yourself honestly what you would pay for that property if you didn’t have a vested interest. Don’t bring up what might happen in the local property market. Valuers can’t make assessments based on market trend, because it’s not foolproof – predictions can and do change. Valuers’ opinions hold a lot of weight with lenders because they tell it like it is. They are expected to paint a picture of the middle ground and serve as the voice of reason for a buyer.

Knowing how to think like a valuer helps you keep a level head where a property is concerned, and gives you a better idea of how to generate good value from it. At the end of the day, property investment is a business, and you need to approach it with that in mind.

A VALUER’S PERSPECTIVE

Be thorough

Inspect every aspect of the property that you think could affect its market value – both within and beyond the main dwelling.

Know the market

Don’t scrimp when it comes to investing your time in research – it’s important to be properly informed about the suburb, so go to as many sources as you can find.

Compare everything

Don’t just compare with similar properties in terms of price – compare in terms of the blocks of land, ancillary improvements, and the condition of the dwellings themselves.

Get multiple appraisals

Rather than going by the word of one local real estate agent, get appraisals from five or six different professionals to gain a clearer understanding of the home’s market value.

Stick to the status quo

The property should match its neighbours in terms of facilities, but over-the-top extras may not add value. Covered parking is beneficial, but an inbuilt garage could be overcapitalising.

Take a detached viewpoint

Seek to back up real estate agent appraisals with those of independent valuers. Confirm the validity of the data you have received as well as you can.