Many investors get into property investment for the money. But for Mathew Cosgrove, it’s about so much more – including boosting his self-confidence, proving himself, and making his financial dreams come true.

The desire to achieve something ‘big’ in the world is a near-universal desire. Everyone wants to make their mark in some way. For Mathew Cosgrove, that way was property investment. Mathew made his first appearance in Your Investment Property magazine when he was awarded as a runner-up in the Investor of the Year awards for 2009. When he began investing, he was an environmental scientist with only $20,000 to start with. However, in the space of three years he was able to build a four-property portfolio. He was 25 at the time, and was hoping to retire within a decade.

We caught up with Mathew a few years later in the midst of the mining boom. He was midway through developing the Nundah property he’d purchased in 2008 and had just overcome some financing issues. He was also enjoying massive growth of his properties in the suburb of Moranbah, where rents had soared due to the start-up of several mining projects. He was also looking to mentor his two younger siblings, who were beginning to show an interest in property as well.

“I was in a job, and I wanted to break the cycle. The main reason I got into property investing was that I wanted to do more and have more self-worth,” Mathew explains. “In my mind, it was the best way to prove to myself that I could achieve things for myself and bring myself to the lifestyle I wanted to have in the future.”

“My whole mantra is cash flow,” says Mathew Crosgrove. “It’s key for any property investment”

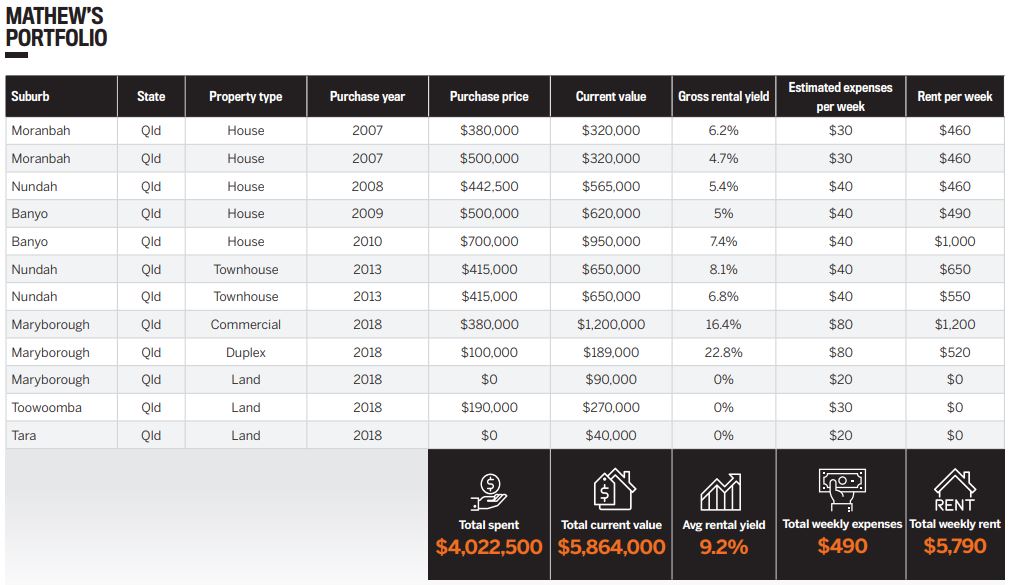

AT A GLANCE

AT A GLANCE

Years investing: 11

Current number of properties: 12

Portfolio value: $5,800,000

Learning to thrive in a falling market

Mathew has now officially celebrated 11 years as an investor, and today his $1.8m portfolio comprises a whopping eight residential properties, three pieces of land and one commercial property, all in Queensland. However, his choice of investing location became an issue when the mining industry went into a downturn.

“The property market did tumble severely – it was way overinflated. Our property in Moranbah went up close to $900,000 in value, and then had a significant drop to around $300,000.”

Mathew didn’t throw in the towel but worked to make the most of the situation. He had built a new property, and he kept a low profile in the property market for the next five years as he focused on maintaining his portfolio.

“We’d kind of maxed out our loans, so our properties had to grow first. My portfolio was adjusting, with Brisbane properties rising and regional properties going down in value. It’s not easy to borrow money, because the lending criteria of banks have been stringent everywhere,” he says.

“In the meantime, I was getting development and building approvals for a lot of my properties. I’ve got a container house I’m building at the back in Banyo; building underneath my house in Nundah into another unit, then I want to build five units on a block in Toowoomba.”

Now that the Queensland market is picking back up, Mathew is reaping the rewards of his patience.

“The different markets I owned property in went through cycles, but in every property cycle there is opportunity. When to capitalise on certain opportunities has been my biggest lesson,” Mathew says.

Big moves with big returns

Mathew has also embarked on his first foray into commercial property.

“My whole mantra is cash flow – it’s key for any property investment. You really can’t develop or do anything without income, and commercial property offers the best sort of returns,” he explains. His first commercial investment, in Maryborough in 2018, involved one large property with a potential eight titles.

“I bought it on contract with a friend of mine, and we strata-titled it before we settled, and sold three or four of the units to pay for the entire block, so it was ultimately a no-money-down deal.”

While Mathew looks back on this as a potentially risky move, it paid off for this investment, and he intends to explore commercial property further.

“My whole mantra is cash flow – it’s key for any property investment. You really can’t develop or do anything without income, and commercial property offers the best sort of returns,” he explains.

His first commercial investment, in Maryborough in 2018, involved one large property with a potential eight titles.

“I bought it on contract with a friend of mine, and we strata-titled it before we settled, and sold three or four of the units to pay for the entire block, so it was ultimately a no-money-down deal.”

While Mathew looks back on this as a potentially risky move, it paid off for this investment, and he intends to explore commercial property further.

Portfolio timeline

2007

Mathew buys a property in Moranbah that he subdivides into two houses

2008

He makes his next purchase for under $450,000 in Nundah. The house is now worth over $560,000

One of Mathew’s earliest purchases of a house in Nundah is still paying off with a 5.4% yield

2009

He buys a house in Banyo, which now generates a strong yield of 5%

2010

Mathew snaps up another Banyo property – it is expensive at $700,000, but in 2019 he benefi ts from a hefty yield of 7.4%

2011

His Moranbah properties, purchased in 2007, leap in value to a peak of $850,000–$900,000 each four years later

2012

One year on, the Moranbah property market collapses and Mathew’s properties in the area slump in value to around $300,000 each

Mathew’s houses in Moranbah have seen a dramatic drop in value since their peak in 2011, but together bring in rent of $920 per week today

2013

Mathew adds a pair of townhouses in Nundah to his portfolio, while the Queensland market continues to plummet due to the mining downturn

2018

Now a licensed buyer’s agent, Mathew makes a triumphant return to property buying with the purchase of properties and land blocks in Maryborough, Toowoomba and Tara. He also invests with a friend in his fi rst commercial property in Maryborough – in a deal done with no money down

“It will involve strata-titling and developing different styles of buildings on some pieces of land I have, including SOHO (small office/home office) buildings where people can set up their businesses where they live. I believe there is a very large future in this, and I have some very good designs I can’t wait to complete,” Mathew says.

As for that retirement goal? While he doesn’t consider himself retired, Mathew has long since been able to leave his nine-to-fi ve job. He struck out on his own in 2014 to focus on property and enjoy his hobbies, such as playing in his band.

“I got my real estate licence and I do some work as a buyer’s agent. I’m not working every day for 14 hours. Although some weeks I’m busy, I always prioritise the stuff in life that’s fun, because I might not be around tomorrow.” Mathew’s younger siblings have also joined him as co-owners and co-shareholders in some of his properties.

“They’re learning as they go; they’ve let me take the reins, and understand that there’s benefit for them in the end,” he says.

Mathew’s investment career and ability to power through a dificult market has rendered him knowledgeable enough to be able to advise others on property buying, but he still maintains a humble attitude to his experience.

“I’m not sure if I’ve inspired anyone, but if I have, that’s awesome. [Property investment is] a big thing; it’s not easy, but once you throw yourself in and you go into survival mode, you have to get things done,” he says.

“I’m not a smart guy. I just see potential and try to learn as much as I can. I’ve made lots of mistakes. I’ve seen my properties go down 50–60%, I’ve seen them go up 80%. It’s about balance and understanding risk.”