07/06/2018

For Arjun Paliwal, property investment has always been in his blood.

“My father has had significant success in property through his life, and so he’s the number-one inspiration for me. I knew that, at some point, I would follow in his footsteps with property,” Arjun says.

Working at a major bank gave Arjun a strong understanding of mortgages and access to a constant stream of inspiring property investment stories from his clients.

His first foray into real estate was his own home. When Arjun and his wife, Leigh, bought their home in Sydney, it came with a large mortgage, so they had to manage their finances carefully.

“This was a period where we were both going through rapid career progression. Having a savings plan during this growth phase kept us strict about our spending, rather than increasing our outgoings, which is what most people do when they get a promotion with a pay rise,” Arjun says.

“We were able to make some tweaks to the way we lived, and as a result, we were able to save the same amount – if not more – even though we had a large mortgage. If a Sydney mortgage couldn’t hold us back from saving, then we knew nothing could!”

At around this time, Arjun met buyer's agents Scott and Mina O’Neill, and the couple’s story gave him a new perspective as he and his wife began their own investment journey in 2015.

“We felt that if another young couple could do it, we could have the confidence that if we set the focus on growing our portfolio, we could do it, too.”

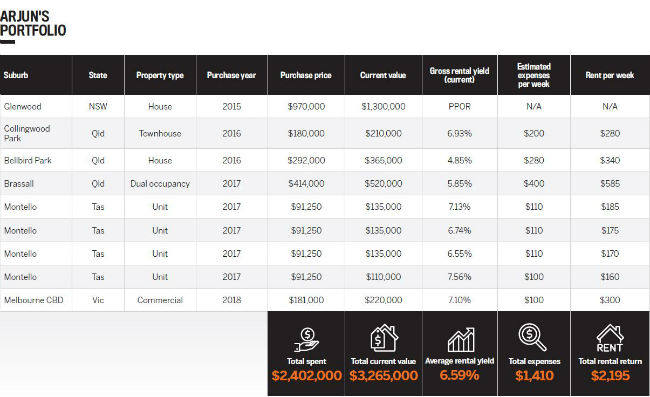

AT A GLANCE

Years investing: 3

Current number of properties: 9

Portfolio value: $3.265m

Developing a strategy

One of the first lessons Arjun learned was to consider investing with a cash-flow strategy, and he and Leigh soon adopted the philosophy that ‘cash flow is key’.

Leigh also provided invaluable support, both personal and professional, as Arjun began the process of buying property.

“I did the research and all the liaising with different parties on each property, whilst she provided her 100% commitment to the savings plan and played a key role in being the person to bounce ideas off of, as she had significant banking and property experience, too,” Arjun says.

In the three years since they began investing, Arjun and Leigh have refined their strategy into one that involves purchasing a combination of residential and commercial properties that generate high cash flow and have capital growth potential. As a result, they are building a portfolio that both income and grows in value.

"My father has had significant success in property through his life, and … I knew that, at some point, I would follow in his footsteps"

“For every three properties we purchased, I would ensure that two are heavy cash-flow-focused whilst one, at minimum, is cashflow- neutral but shows the most promise for future growth,” Arjun explains.

“This way, I can continue to top up properties where needed to make up gaps in deposits for future purchases. This strategy also ensures that each time we go to the bank for further lending, our income is increasing.”

Looking at all options

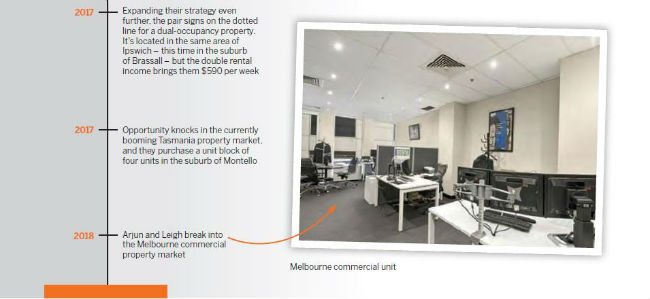

In 2017, Arjun and Leigh purchased their fourth and best property to date – a dual-occupancy dwelling in Brassall, Queensland.

“We were able to secure the property just before dual-occupancy and duplex properties started to become really popular. It offers great returns since it is a new build with many tax benefits, and as it is a dual occupancy, it offers plenty of cash-flow benefits,” Arjun says.

Their valuer recognised the growing demand for such properties and almost immediately provided a valuation that was considerably higher than the Brassall dwelling’s original purchase price. This enabled Arjun to get a bigger loan and limited the amount of cash he needed to hand over. As a result, he had more funds to spend on his fifth property.

Arjun credits the people on his team for providing additional perspectives and helping him make the right deals.

“In every purchase, my solicitors provided a different view on things and also provided me with avenues to look into that I was not aware of,” he says.

By exercising extreme due diligence, he adds, he has passed up five contract exchanges – for good reason.

“It’s okay to miss out – there is always another deal out there. Although the legal costs and time spent add up, it has been well worth it and a valuable learning experience. No matter how experienced you are as an investor, each and every transaction is different.”

Arjun also aims to continue being prudent in expanding his portfolio.

“We would like to continue the trend of buying more properties; however, I do see myself having a moment in my investing journey where we will have a year or two of inactivity,” he says.

“The purpose of this would be to further pay down debts and take advantage of the accumulated growth over that period to invest in a larger-scale deal.”

Arjun cites high-end commercial properties or developments as his future goal, as the right ones can “help double the size of a portfolio in terms of cash flow and value”.

Sharing the benefits

After just three years of investment, Arjun and Leigh have amassed a nine-property portfolio with equity of more than $900,000. Even so, they are not slacking off where wise budgeting is concerned.

We understood that we could not solely rely on capital growth and equity loans to help us grow our portfolio. Although our incomes are on the higher end of the scale, [our] mentality always has stayed the same since our first jobs in the banking industry,” Arjun says.

That said, Arjun’s success in property investing to date has paved the way for him to achieve early retirement. He left his 9-to-5 job in March, and he looks forward to pursuing a life of fitness and travel. In addition to tripping overseas for a few months per year, he hopes to set up his own business.

“I see this as just the beginning of the journey,” he says.

“I will do property renovations on my current portfolio, along with property development joint ventures, and I have a few business ideas that I’m doing further research on. My aim is to create enough income through these multiple avenues to eventually get my wife out of work to join me!"

This involves picking the right solicitor, buyer's agent, accountant and bank. Look at their body of work, as well as their ability to think both long- and short-term.

Don’t invest on emotion – make sure you’re sticking to the facts. There are always more deals out there.

Heed advice not just from property experts, but even those who aren’t involved in the transaction. Sometimes an outsider’s perspective can be helpful.

Save enough to pay off at least three months' worth of expenses in case of an emergency, and budget carefully when buying.