31/10/2018

John and Lani Tucker started their respective relationships with property separately, in the mid 2000s. At 24 years of age, John bought his first property in Melbourne for $45,000, while Lani made her first investment in her native UK.

“These were our attempts back then to provide shelter and escape the nest,” John explains.

“We then went on to sell those properties for differing reasons – mine was to seek investment elsewhere and Lani’s was to relocate to Canada.” John did not think about growth or future potential when he purchased his first home, though he fortunately made a profit when it sold for $105,000 a number of years later. Instead, at the time, he elected to invest in shares via margin lending.

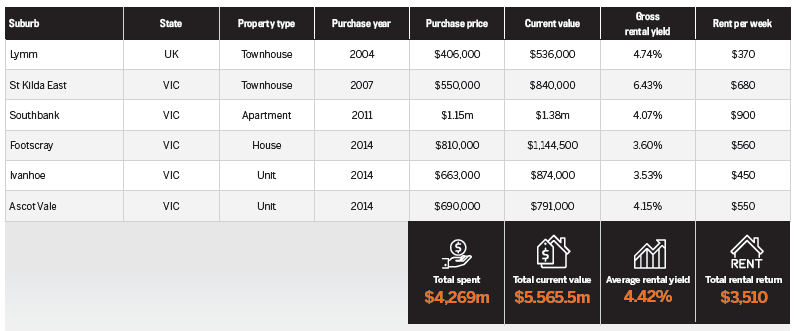

He eventually moved into property investing, buying a townhouse in St Kilda in 2007 – a property he ended up renting out to the original vendor for a few years. Lani also bought her own townhouse in Lymm, outside of Manchester in the UK.

AT A GLANCE

Years Investing: 11

Current number of properties: 6

Portfolio value: $5.5m

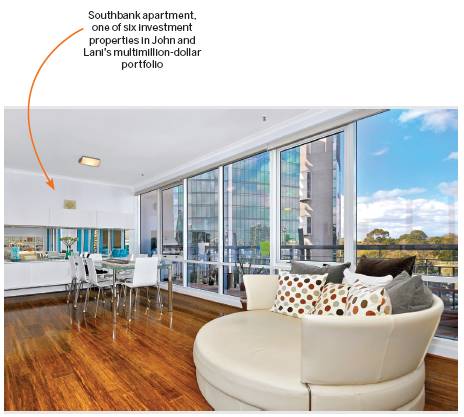

In 2011, the couple began their shared investment journey by purchasing their first principal place of residence in Australia, with an aim to eventually convert it into an investment property.

“We then got married in 2013 and looked to formulate a plan for our retirement together – and we saw property to be the vehicle for cash flow,” John says.

The following year, the couple began to take a serious look at how to build their portfolio. Their research led them to property investment advisory firm Empower Wealth.

“I found Empower Wealth videos online that outlined how a conservative plan and correct approach could allow us to invest in the right assets, in the right locations, to allow growth and passive income for our early retirement,” John says.

“Their approach resonated with us, and our first meeting confirmed this. We engaged with their buyer’s advocacy approach, which was a shared way of suggesting properties that we then viewed, inspected and confirmed to purchase. We’ve found the advice, guidance and benefit to be invaluable.”

Buy no more

After purchasing three properties in Footscray, Ivanhoe and Ascot Vale in 2014, John and Lani quickly determined that they were not the kinds of investors to build massive portfolios.

“We have completed our property portfolio. We’ve now rented out our principal place of residence as our final investment property in Australia and have begun renting in our preferred beach location whilst we continue to work in Melbourne,” John says.

The couple’s strategy rests on maintaining a small portfolio of positively geared properties, enabling them to earn a strong passive income.

“We have no additional plans, apart from continuing to keep our tenants happy in all of our properties by attending to any issues that arise, as well as being proactive in making improvements for the people and properties,” John says.

Their most successful investment in this regard has been their Footscray house, which was purchased for $810,000 and is presently valued at a little over $1.14m.

“The quality and type of house has seen long-term tenants and very little ongoing costs,” John says.

Another standout investment has been the townhouse the couple bought in St Kilda, which is the top-growing property in their portfolio.

“It has probably had the best overall growth, which is a reflection of time in the market. It also has a higher yield but more frequent tenant turnover.”

Lani has also held on to her townhouse in the UK, which has been maintained with the help of a property manager based there, and by filing a UK tax return annually.

“Communication is key, and we tend to perform an inspection ourselves when we pop back to the UK. The property manager keeps in touch as and when needed via email. We also travel back regularly, at least once every 18 months, to visit our many family and friends there,” Lani says.

“The value [of the property] has increased – the location is sought after and in good proximity to transport and to Manchester.”

Currently, their multimillion-dollar portfolio consists of five properties in Victoria and one home in the UK. It’s a portfolio that John and Lani hope will carry them all the way to retirement.

Gearing towards a bright future

Throughout the years, the couple has learnt the importance of knowing their life goals and the purpose of their investments, as well as how their family’s plans and circumstances figure into this.

“Ultimately, we wish we’d had advice and knowledge rather than just jumping in. Some of our earlier properties we may not have purchased given what we know today,” John says.

“Now we have a biannual review of the plan. We also use Empower Wealth’s mortgage broking services, which allow for periodic check-ins on our mortgages and any rate adjustments. In the event our plans were to change, we’d also consult further.”

Four years after John and Lani officially embarked on their property investment journey as a couple, their initial plan to fund their retirement via cash flow generated has been paying off.

“We embarked on this life plan that has focused on completing a property portfolio. It’s our plan and goal to retire in our mid-50s with our current portfolio; that is, no further purchases, with cash flow enabling us to enjoy the lifestyle and freedom we seek,” John says.

While he is no longer involved in margin lending, and the couple has not bought shares in a decade, they continue to supplement their income by participating in dividend reinvestment.

“During retirement, we plan to give back by volunteering our time. We enjoy travelling, and the benefit of volunteering allows us to do so across countries. [We] wish to spend time with friends and family also, by extending our travel and following the sun, with maybe six months in Europe and six months down under,” John says.

“We’re on track and about 50% of the way towards our goal. We anticipate hitting our 100% target in about five years, based on our current trajectory. Our plans could change along the way as life continues to unfold – if so, we’ll adapt!”