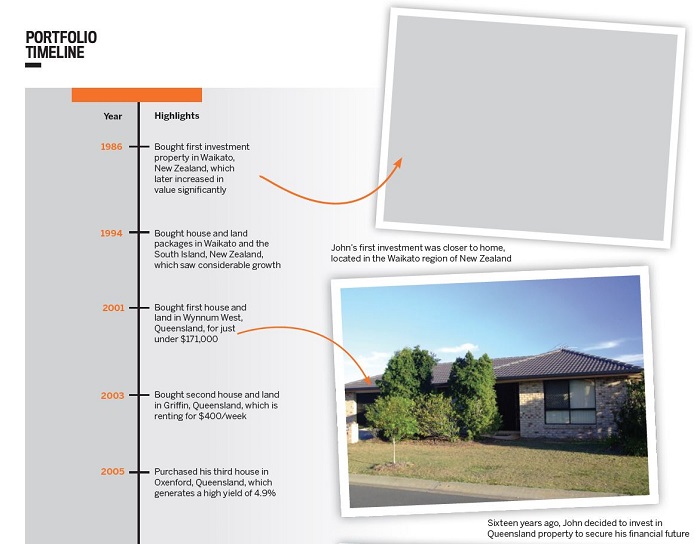

AT A GLANCE

Years investing: 31

Current number of properties: 6

Portfolio value: $2.28m

John Chandler has spent most of his life surviving on a low income, with a limited social network.

“I spent half my working life in the hills, bush shooting and hunting deer for the New Zealand Forest Service – I was pretty much a hermit!” he says.

When he made the transition into the hospitality industry, his financial prospects did not improve much, as his salary was barely above the minimum wage. As a result, property became a way for him to strengthen his financial standing.

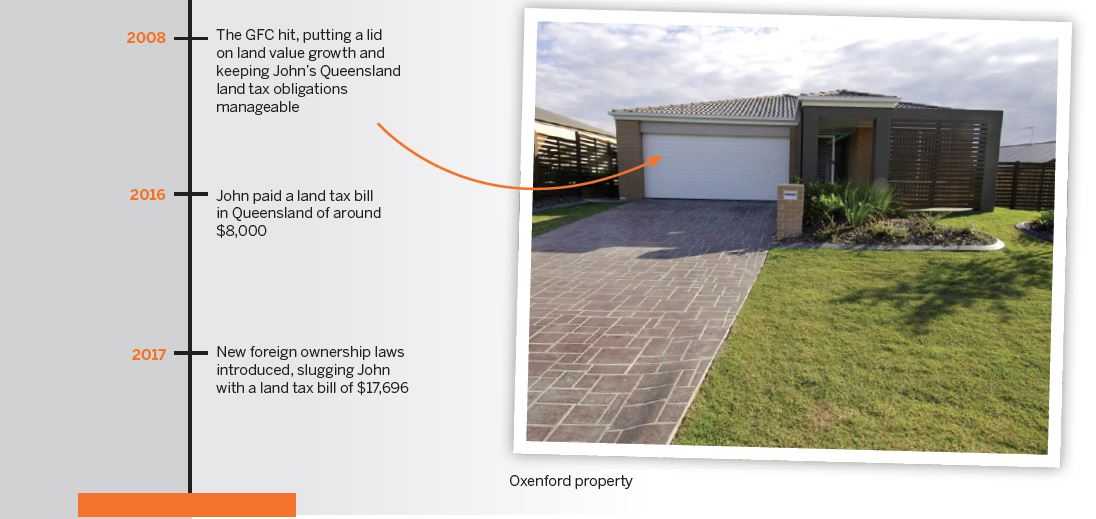

In 1986, he made his first investment in his native New Zealand when he bought a house and land package in Waikato, making a tremendous profit.

“The property was bought for NZ$65,000, and I still own this property today; it’s valued at NZ$370,000,” he says.

Bolstered by his success, John bought his second property in Waikato – again a house and land – in 1994, for NZ$89,000. Today this home is worth

NZ$360,000. In that same year he picked up another property in the South Island for a very low NZ$45,000 – this home is presently valued at NZ$140,000. Almost a decade later, John decided to extend his portfolio to Australia.

“In 2001, I paid for my parents to go on holiday to Queensland, and while there I gave them a budget for a house and land in Brisbane. I ended up with my first Australian property – a Villa World house in Wynnum West.”

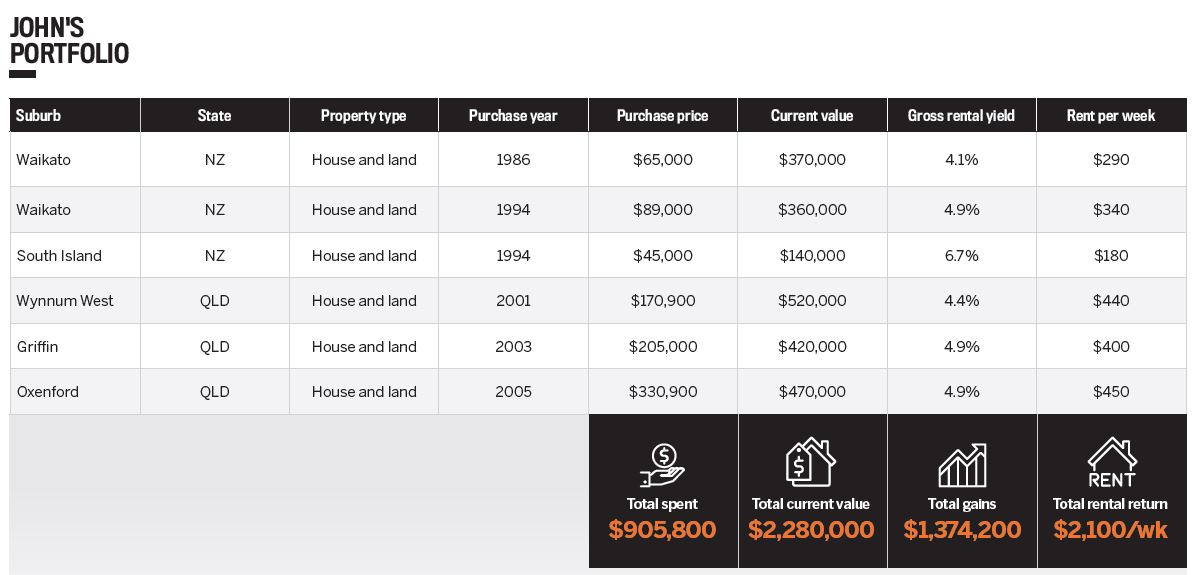

He paid a deposit of $30,000 for the $170,900 home, and while he did have financing problems at the start, he soon settled his first international purchase. This property has since gone up in value by nearly $350,000. Despite doing minimal research on the market, he went on to purchase two more house and land packages in Griffin (Moreton Bay region) and Oxenford (on the Gold Coast) in 2003 and 2005, respectively.

John believed strongly in Queensland’s potential, and this trust has not let him down thus far, with both properties growing in value by a combined total of over $350,000.

Tawa property in Welington, New Zealand

Tax troubles

For many years, John’s investments have ticked along. He’s now retired and his investments provide him with a rental income to supplement his meagre pension, which is currently about NZ$200 per week.

As a foreign investor in Australia, however, John recently found himself saddled with significant tax burdens.

“I had not really allowed for the dreaded land tax. This had steadily climbed, but not to the point where I couldn’t handle it,” he explains.

“The financial crisis certainly helped [keep land values constrained], but with the Queensland government deciding to slug absentee owners, I have just been presented with a horrendous land tax bill of nearly double last year’s. The bill is

$17,696, taking me from a slightly positive position to a grossly negative one.”

This was a huge blow to John, as he had only recently been released from his job.

“After nearly 30 years I was kicked out of work due to developing multiple sclerosis, and I have been stressing quite a lot about cash flow,” he says.

“I now survive on a NZ$200 a week [disability] pension, plus a little positive cash flow on my New Zealand properties.”

John’s low wages left him with little financial leeway – and as a result he has had to consider selling one of his properties in order to manage his property obligations.

“I could muddle through using debt to pay this onerous surcharge, but I would end up another $40,000–$50,000 in debt. Overall, is it worth all the heartache?”

1. Check out state websites

If you own property in Australia and you are not a resident, go to the relevant state website and search for your land tax obligations as an absentee or foreign owner.

2. Take advantage of instalment plans

Know that you can usually pay your land tax obligations in three instalments to assist with managing this huge expense.

3. Spread out

Buy only one property in each state and not all in one state – this way, you might be able to limit the burden of taxes levied by one state government.

Though he’s pleased at how well his properties have performed, this sudden change of policy has left John with regrets about buying in Australia.

To make matters worse, in addition to the taxes that have been siphoning the cash flow from his investments, John is also handling a major termite infestation in one of his Queensland properties. Termites are among the worst nightmares for property owners, since the cost of damage repairs can reach into the high thousands, and then some.

“I wish that I had bought more property in earlier years and in my own backyard in New Zealand,” John admits.

“In New Zealand there is no land tax, no stamp duty, no capital gains tax to speak of – and no termites!”

Looking forward

In light of his problems, being single has been both a boon and a bane for John. It helps that he doesn’t have a family, except for his beloved dog Ellie, to look after and strain his finances further, even if he does feel that couples who bring home two incomes could more easily deal with his situation.

“It is just me at the end of the day,” he says.

If he were enticed to buy in Australia again, John believes he would change up his strategy to invest in other states rather than sticking to just one, limiting the chances of going into the red because of the heavy taxes levied by the state government.

“With the Queensland government deciding to slug absentee owners, I have just been presented with a horrendous land tax bill of nearly double last year’s”

“[I’d] probably buy a couple of lower land content,” he adds.

He would also look to get more advice from others, rather than doing things completely on his own, and he would research more deeply into the tax implications as presented on state government websites so that he knows what to expect in the future.

John’s portfolio is worth over $2m, and taking his debt into consideration, his equity is still worth over $1m. Hence, it will be important that he sells wisely in order to make the most of his portfolio’s position.

John’s portfolio is worth over $2m, and taking his debt into consideration, his equity is still worth over $1m. Hence, it will be important that he sells wisely in order to make the most of his portfolio’s position.

John’s portfolio is worth over $2m, and taking his debt into consideration, his equity is still worth over $1m. Hence, it will be important that he sells wisely in order to make the most of his portfolio’s position.

John confesses, “I was hoping to get to age 65 before having to sell. I cannot help but feel that it has been a bit of a lost opportunity, but overall I have done OK.”

Send your details to:

.JPG)