This article was published in the December 2023 edition of the Your Investment Property Magazine.

After a rocky 2022, many property experts thought property prices would drop further in 2023 - some even going so far as to say they would crash - but as we all know, that didn’t happen. In fact, property prices have increased pretty much every month. It seems to have taken the Reserve Bank by surprise if the October meeting minutes are anything to go by. The minutes showed Reserve Bank board members are concerned about the implications of households feeling wealthier as a result of the “stronger than expected” housing market recovery, which could add to inflation pressures.

“The rise in housing prices could also be a signal that the current policy stance was not as restrictive as had been assumed,” the minutes showed.

The Reserve Bank’s 13 rate increases since May 2022 lifted the cash rate to 4.35% - a 12-year high, as the central bank attempted to bring inflation - currently at 5.4% - back down to the 2-3% range.

All of this has led the major banks and property experts to hastily revise their predictions for the year ahead. So what are the big four banks and economists forecasting for 2024?

Was the 2023 property forecast correct?

Before we step into what’s coming for the year ahead, let’s take a look back at the year that was and if experts hit the nail on the head - or wildly missed the mark - with their housing market predictions.

Off the back of a rocky 2022, many experts including PRD Chief Economist Dr Diaswati Mardiasmo, predicted property prices to soften. And in some ways, they did.

“We did see quite a lot of markets, especially capital cities like Sydney and Melbourne, experience a softer price or price decline,” Dr Mardiasmo told Your Investment Property Magazine.

“We also saw some regional markets experiencing softer prices, but not to the extent of capital cities. This is consistent with what many forecasted back in 2022.”

Dr Mardiasmo noted that low levels of housing supply and high construction challenges impacted price growth in some areas.

“This forecast is certainly correct in many areas, especially in areas that don’t have a lot of ready-to-sell standalone houses or units already in the pipeline. Most of this is in the outer CBD areas and regional areas, where there are already naturally higher construction costs due to transport and freight.”

But she acknowledges there were some surprises.

“The cash rate was held at 4.10% for a few months, which meant that we started to see some small recoveries in certain markets. Even Sydney and Melbourne started to show some small upticks in their median prices,” she said.

“We didn’t really expect this until 2024, so these price increases were a little bit unexpected.”

Expert predictions for what’s in store for 2024

Dr Mardiasmo said property prices are likely to continue on their current growth trajectory in 2024 thanks to a steadier cash rate and an overall sense of being “used to” the current economic phase.

“Last year, we were more on pins and needles in terms of what the RBA would be doing with the cash rate, how it would impact repayments and borrowing capacity. We were also more worried, and almost in shock, with the higher cost of living and having to really readjust our budgets,” she said.

“This time around, the problem of the higher cost of living and higher cash rates still persists, however, it’s a continuation of the previous economic phase. Because of this, demand for properties will continue to increase and with our housing supply continuing to stagnate, we will continue to climb on the growth trajectory.”

But she said it’s unlikely we will see the rocket-like growth that we had post-COVID for three key reasons.

“We have extremely low household savings compared to post-COVID and a higher cost of living, we have a much higher cash rate, and we have less of that FOMO frenzy that we saw post-COVID,” she said.

“We are seeing this now [less FOMO frenzy] with buyers being considerably measured in their decision-making and higher average days on the market, and people are becoming more open to the possibility of living in an apartment instead of a house.

“Basically, we are returning to the strong Australian property market we previously had.”

What’s in store for investors and renters in 2024?

2023 was a big year for investors and renters but most of it wasn’t good. Rental vacancy rates hit new record low after record low while rent prices hit record new highs, and many unpopular taxes and policies were introduced which drove some investors out of the market. One buyer's agency even went so far as to boycott any further investment in the entire state of Victoria!

For renters, Dr Mardiasmo said the news is unlikely to get better anytime soon.

“Unfortunately, I don’t think we will see a lot of relief, due to the rental supply shortage. Yes, we have build-to-rent, which was acknowledged in the federal budget as a possible solution for renters, and it is growing in presence,” she said.

“However, this is still mostly in capital cities - and even then usually in the CBD or fringe CBD suburbs - higher rent, and not everyone is looking for a unit to rent.

“We are seeing some slight relief in different pockets. Certain areas are starting to see an increase in vacancy rates due to more investors entering the market, however, this is not widespread yet and the increase in vacancy rates is slight.”

As for investors?

“I hope that they will come back in full force!” Dr Mardiasmo said.

“We have seen many investors tap out of the market in 2022 and 2023 due to higher costs, not just the cash rate but also insurance, rates, fees and so on, making the investment financially non-viable.

“However, with many costs starting to ‘settle down’ and investors making the decision based on current economic and financial conditions, as opposed to going through shockwaves of changes, we should see an increase in investors returning to the market.

“This has a direct correlation with what will happen to renters.”

Where to for the cash rate in 2024?

In line with many other economists, Dr Mardiasmo believes the cash rate will now stay on hold until the latter half of 2024.

“I know there is some chatter about the RBA cutting rates, but based on the current inflation rate trend and on the August statement of monetary policy, my thought is that this would happen more towards the end of 2024 or early 2025 - if at all,” she said.

“At the end of the day, it really depends on how inflation rates travel.”

CommBank 2024 forecast

CommBank head of Australian economics Gareth Aird believes the cash rate will remain on hold at 4.35% for an extended period.

“Our central scenario has the RBA on hold from here and we continue to look for an easing cycle to commence in mid-2024,” CBA head of Australian economics Gareth Aird said.

The bank predicts we will see a total of 100 basis points worth of rate cuts by the end of 2024 consisting of 25 basis point rate cuts in May, August, November and December.

“We still expect a 5% gain [in property prices] in 2024. This increase would take home prices 2.3% above the last peak reached in April 2022, before a 10% peak-to-trough fall occurred as the RBA began to lift interest rates.”

Westpac 2024 forecast

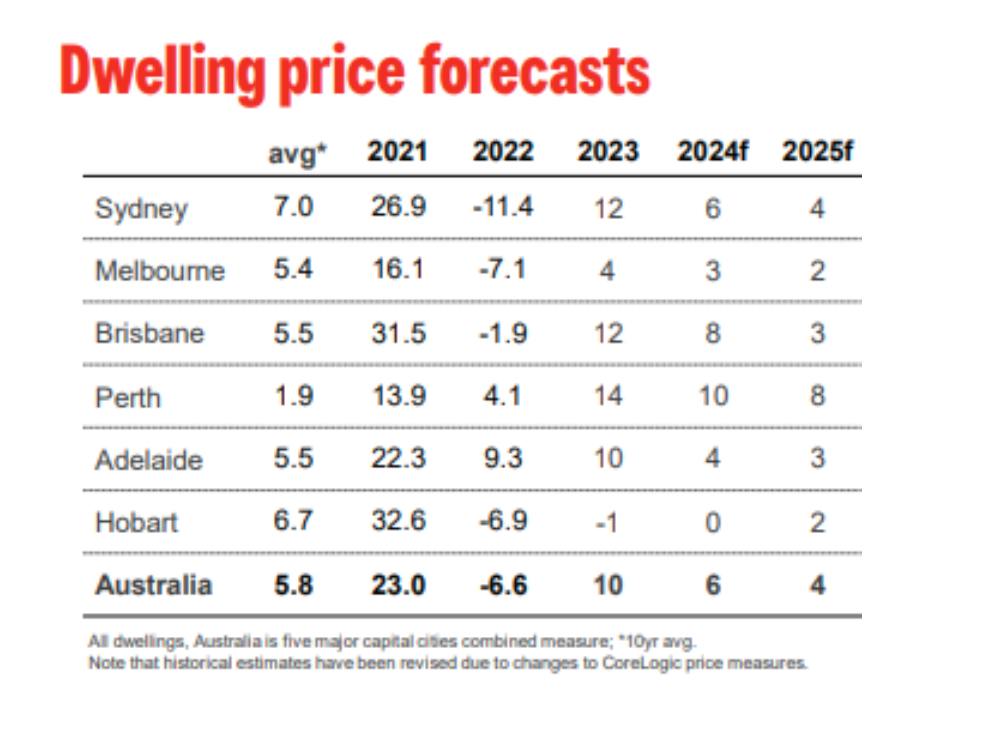

In November, Westpac economists lifted their 2024 national property price growth forecast from four to six per cent on the back of a strong finish to 2023.

“While we still anticipate a slowdown in 2024, the stronger momentum looks likely to carry a little better near term,” Westpac senior economist Matthew Hassan said.

“Aside from stretched affordability, a slowdown in aggregate population growth and shifts in internal migration and household formation will shape performances in the next two years. The path of inflation and interest rates remains a key risk.

“Qld, SA and WA are all showing better momentum in terms of both prices and turnover and will be clear frontrunners next year, WA showing the best prospects.”

Westpac chief economist Luci Ellis doesn’t expect the RBA board will hike again at its December meeting but believes all meetings in 2024 could feasibly bring further rate changes.

ANZ 2024 forecast

ANZ Bank has revised its forecast and now expects property prices to slow to around 3-4% in 2024, reflecting rising unemployment and the lagged impact of past rate hikes as well as slower population growth.

At the time of writing, ANZ hasn’t yet locked in a prediction of more rate hikes.

“We have not seen enough data to add a further rate hike to our forecasts yet, but will be watching the data closely in the coming weeks,” ANZ senior economist Adelaide Timbrell said.

NAB 2024 forecast

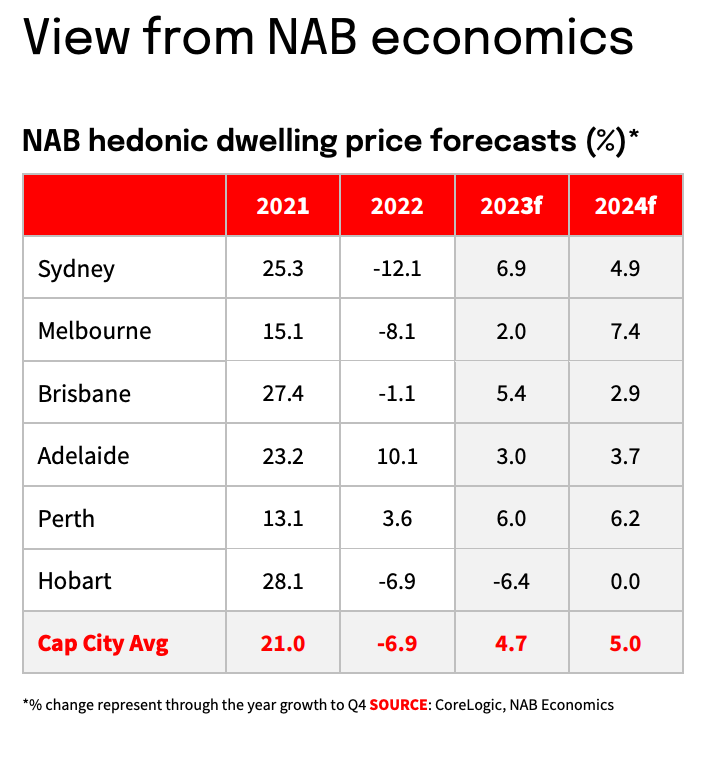

NAB economists also predict slower property price growth through 2024.

“With the trend in house prices unlikely to change significantly over the next three months, prices are likely to end the year 8-10% higher and we continue to see gains of around 5% over 2024,” NAB Group Chief Economist Alan Oster said.

Mr Oster believes we’ll see one more cash rate hike, most likely in February.

He predicts the cash rate will rise to 4.6% when the central bank’s board meets for its first meeting of 2024.

“Recent communication from [RBA Governor Michele Bullock] has made clear the board was already at the limit of its tolerance for inflation remaining above target,” Mr Oster said.

“Given the revisions to the outlook, we expect the board to form the view that a single 25 basis point adjustment to rates is not enough to mitigate the risks on inflation.”

A sneak peek into the 2024 property crystal ball

|

Bank |

Property prediction for 2024 |

Cash rate prediction for 2024 |

|---|---|---|

|

Commonwealth Bank |

5% growth |

On hold until rate cut in September 2024 |

|

Westpac |

6% growth |

On hold until rate cut in second half of 2024 |

|

NAB |

5% growth |

One more cash rate hike, likely in February |

|

ANZ |

3-4% growth |

On hold until rate cut in late 2024 |

Image by Freepik