While it might seem like successful property investors have some secret formula, the truth is that they often share common characteristics that set them apart.

Now over the years, our team Metropole have helped thousands of clients grow significant property portfolios and achieve financial freedom, so I spent quite some time researching their results to see what differentiated the successful investors from the average investor.

Here’s what I found…

Firstly I looked at the results our clients achieved.

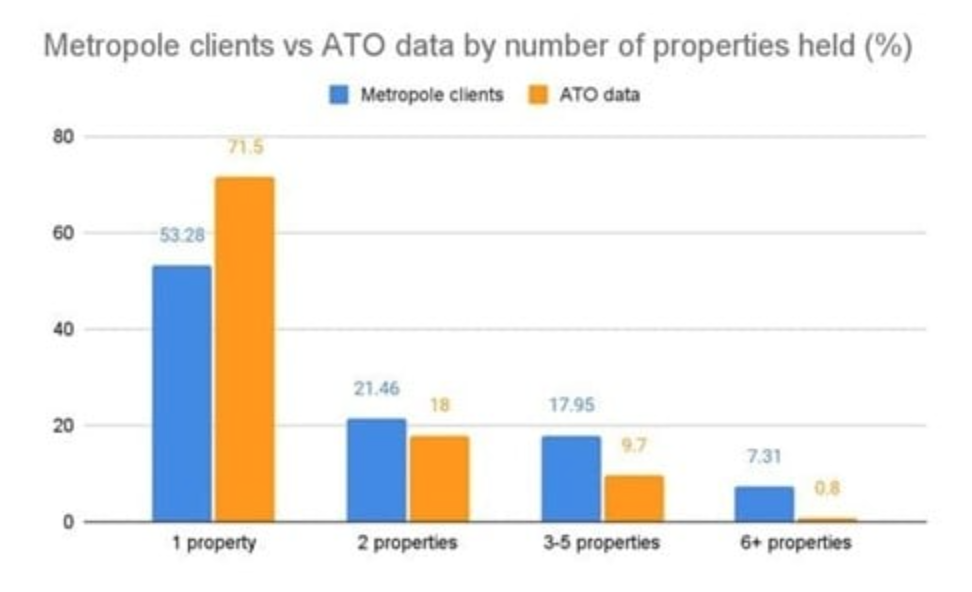

- Only around half of our clients own only one investment property - considerably below the Australian average because according to the ATO around 72% of Australian investors get stuck at one property

- 21% own 2 investment properties (far higher than the Australian average)

- Almost 10% own 3 investment properties (again far higher than the average)

- 6% own 4 investment properties

- 3% own 5 investment properties

- 7% own 6 or more investment properties – more than 7 times the number in the general property investment community.

You can see in the chart below that our clients outperform across the board when compared to data for the average Australian investor.

This means our clients are 7.3 times more likely to be in the top 1% of investors (those who own 6 or more properties) than the average Australian investor.

We’d like to think our strategic approach to investing has contributed to our client’s consistent outperformance.

Part of their success is down to our expertise and experience, but there is more that has helped to fuel their success - their common characteristics.

We know that successful property investors often share common characteristics which set them apart from the average investor.

So I dug deeper through our successful property investment clients at Metropole to see what defining traits this top 1% of property investors all have in common, here are…

11 traits the most successful property investors have in common

1. They have a strategy

Property investment is a process, not an event.

In fact, it's a long-term journey lasting over 20 to 30 years before developing financial independence, and the properties these successful investors owned were the physical manifestation of a number of important strategic decisions they made, and made in the right order.

These successful clients of Metropole understand how important a strategy is, and, with our help, all have one in place to help keep their investment decisions on track.

As a result, they don’t get distracted by the latest fad or idea and they are able to avoid distractions - they never make plans based on the last 30 minutes of news.

They also recognise that property investment is really a game of finance with some houses thrown in the middle, so an important part of their plan was a sound financial strategy to help buy them time to ride the ups and downs of the property cycle.

Not only that but these top 1% of property investors have mitigation strategies in place, own the right properties in the right entities and have financial buffers in place to ensure that they can ride the market as it goes up and down through the cycle.

2. They keep their emotions in check

These investors all leave their emotions at the door - they make decisions quickly with their heads, not by using their hearts.

They don’t succumb to FOMO (fear of missing out), becoming emotionally attached to a property or buying the wrong thing for the wrong reason.

Instead, they treat their property investment like a business.

They commit, they set goals so they’re accountable and they stay on track with their strategy.

3. They recognise the importance of capital growth

Our outperforming property investors recognise that capital growth is the key to creating wealth through property investment.

When you consider the capital growth you’ll achieve from a well-located property, the overall returns are very good.

This capital growth is not taxed unless you sell your property (and why would you do that?) which enables you to reinvest your capital to generate higher compounding returns.

This means for investors in the asset accumulation stage of their journey, the more capital growth you achieve (even at the cost of lower rental income) the more wealth you will accumulate in the long term.

Our clients all recognise that cash flow keeps you in the game, but it's capital growth that gets you out of the rat race.

Therefore, they all invest with the main goal of capital growth, realising that this means less cash flow in the short term while they enable themselves to buy more properties in the long term and boost their capital growth further.

4. They understand the importance of quality vs quantity

Another thing that this group of successful investors have in common is that they understand the difference between an investment property and an investment-grade property.

They recognise that they can’t expect investment-grade returns from secondary properties and prioritise buying only investment-grade properties in A-grade locations over buying several properties.

This means that they don’t just buy ‘cheap’ properties, and they avoid buying in a ‘trending’ area or buying properties that they wouldn’t feel comfortable living in themselves - they focus on quality over quantity.

5. They have a long-term view

Another key trait we’ve recognised in our more successful clients is that they’re able to delay gratification.

We encourage our clients to take a long-term view and advise them not to get caught up in property cycles.

Successful investors understand that the result of successful investing is to give yourself more choices in the future.

They’re not looking for short-term profits or an immediate cash flow but rather a legacy for their children and future generations, so their property journey often spans 20, 30 or more years.

They buy their properties in structures that are tax effective, protecting their assets, and allowing them to pass on their wealth to future generations.

6. They have a good team around them

You’re only as good as the team around you - these successful investors understand that they will never achieve the same level of success alone, no matter how knowledgeable or experienced they are.

They also know that hiring the right professionals is a non-negotiable aspect of successful investment.

They have gathered great professionals around to give the best support and advice, such as a mortgage broker, a financial advisor, a solicitor and a property advisor which makes all the difference between starting off a successful and profitable property journey.

7. They know when to step back

Knowing when to step back from making a move is just as important as actively searching for the right investment opportunities.

I’ve noticed that successful property investors understand that sometimes the right thing to do… is nothing, and instead allow time to let leverage and compounding work its magic.

In fact, I've often said I have made more money by saying “NO” to perceived opportunities than yes to them.

Not only that, I’ve noticed all our successful clients are happy to take a hands-off approach.

They continue to enjoy their careers and lifestyles and leave the day-to-day matters of property management with someone else.

Their property investment isn’t a lifestyle change or a method for instant retirement, it allows them to improve the life they’re already working on… and has given them more choices and better security along the way.

8. They evolve

Creating and following a strategy and having goals set in place are incredibly important to achieve true success.

But learning how to evolve those plans and change them along the way, if and when appropriate, is just as important.

Our successful property investing clients all adapt and evolve throughout their property investing journey.

They also do this through continuous learning – smart property investors never stop learning.

They attend seminars and webinars, listen to podcasts (including The Michael Yardney Podcast), read books and blogs and stay updated with industry news.

It’s this continuous learning process that keeps them ahead of the curve in their property investment game, and almost certainly helps secure a space in the top 1% of Australia’s investors.

But they are very careful who they listen to and take advice from.

They recognise that everyone seems to have an opinion about property and investing, but they only take advice from those who have achieved the results that they're looking for themselves and have retained those results over the long term.

9. They grow and diversify

Over time the successful investors I studied developed a diversified portfolio with properties in different states around Australia – mainly in our three big capital cities.

And eventually upgraded their game from being passive investors to becoming more active investors by getting involved in renovations with development.

10. They are tenacious

Tenacity or sheer grit can often make the difference, and I’ve identified fierce tenacious traits in all of our successful property investor clients.

The willingness to push through challenges, to not take ‘no’ for an answer and to stay committed even when the going gets tough is indispensable.

11. They all have a different background

The interesting thing I noted when looking through our group of successful clients, is that while they have many traits in common, there is one area where they represented true diversity.

You could say this is something that they all have in common too… that they’re all different.

Their background, race and income all vary wildly and have no implication on their success as property investors.

We have seen many people with high incomes, but poor financial discipline come through our door, and were unable to build a substantial portfolio.

Meanwhile, others with relatively low incomes but with financial discipline have been able to build substantial portfolios.

Many people often think… ‘But I’m not rich enough to be a property investor’... but our most successful clients prove that’s just not true.

Our most successful property investors come from all backgrounds, and all walks of life and have various incomes.

The takeaway

At Metropole we recommend property investment as an excellent wealth-creation tool because it provides both high capital growth which grows your net worth, and a secure income which increases over time, to help you pay the mortgage.

While it takes a few decades to grow a sufficient size asset base to become financially independent, using the power of leverage, it is possible to speed it up.

It’s true that there is no “secret” to achieving significant net worth.

That’s because the path to success in property investment is multifaceted, requiring a blend of various skills and characteristics.

While this isn’t an exhaustive list, these traits identified in our clients serve as a strong foundation for anyone looking to excel in the property investing field.

Remember, every investor is unique, and the most successful ones often possess a unique combination of these traits tailored to their individual journey.

After all, success in property investment is not just about having money to invest; it's about having the right mindset and skills to navigate a complex and ever-changing landscape.