2/08/2018

"Always buy with your head, not your heart, unless you’re going to be living in the property"

AT A GLANCE

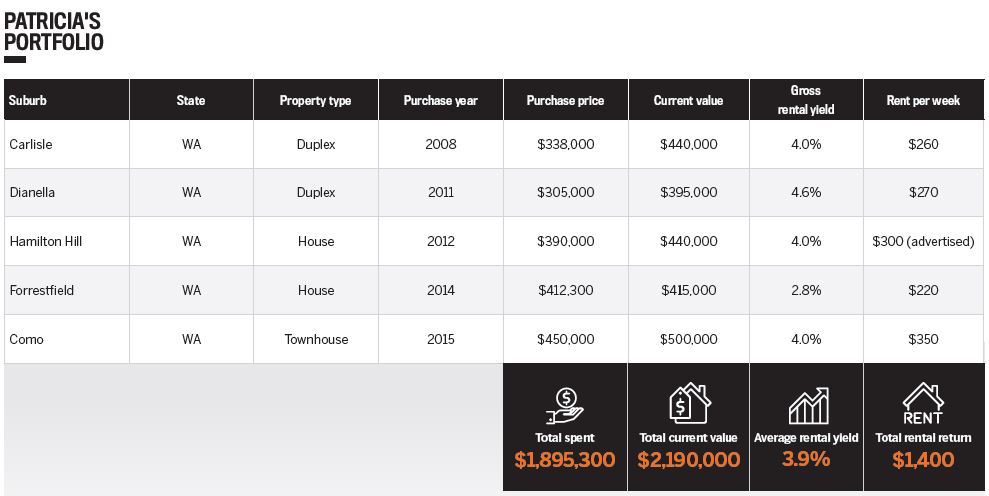

Years investing: 12

Current number of properties: 5

Portfolio value: $2.19m

Patricia Cheah inherited her interest in property from her mother as a child.

“My mum would drag us out to home opens when we were young, and that first sparked my love of property,” she says.

“She used to tell me how much she regretted selling our past homes. In hindsight, she wished she’d kept them as investments.”

One of these regretful sales was the family’s home in the Perth suburb of Thornlie, which they sold in December 2000. The property was eventually resold by its new owners 11 years later for almost three times what they bought it for.

“It was stories like these that got me interested in property investing. I could see the long-term benefits of capital growth and how it could fund a comfortable retirement,” Patricia explains.

So in 2006, at the age of 19, she took the plunge on her first investment – a block of land in Yangebup, WA.

“My friend had suggested that Yangebup was an up-and-coming area, so I took their advice and purchased a block with ocean glimpses. My parents put the property in their name as they were able to secure a loan; however, I made 50% of the repayments,” Patricia says.

“It was an impulsive buy. I was young and somewhat naive – if I had known then the information that I know now, I probably would have scared myself out of investing. But in this case, ignorance played in my favour. I didn’t get any expert advice, and I didn’t really do any research. I purchased with my heart and not my head, but it worked out.”

The long haul

Patricia would go on to purchase three more homes in the next five years, two of which were sold at a profit. However, her beginner’s luck would soon run out.

“I made a loss early in my investment journey after purchasing an off-the-plan apartment in Northbridge, a city centre,” she says.

“I think I bought above market value – this is typical in new developments because there are a lot of parties involved and they all need to be paid.So the developers typically add a healthy margin to the sale price.”

Patricia signed the contract back in 2007, but the development itself was not completed until 2009. And as Perth’s value as a capital city went down, so did the chances that the property would make money.

“I sold in 2012 at a loss of around $50,000, after stamp duty and other costs,” she says. This severe blow to her finances taught Patricia “to do my research before jumping in, and to always buy with your head, not your heart, unless you’re going to be living in the property”.

She also realised that new homes might not be the best deal to jump on. “I learnt that the new shiny homes are often the ones that are most appealing, but people tend to overcapitalise on the build, which means it may not produce high capital growth in the future,” she says.

An eye on development

An eye on development

As it is for most investors, Patricia’s property journey has been a bumpy one, but with the struggles have come victories.

“My strategy from the start was always to hold for as long as I could. If I didn’t need to sell, I wouldn’t. But it wasn’t until later that I learnt it was OK to let go of underperforming properties,” she says.

“I also now focus on properties with a decent land component, because they’re not making any more land.” A feather in Patricia’s cap has been her Forrestfield investment – a house purchased back in 2014, which is currently valued at $415,000.

That value is set to surge, however, thanks to a sudden new development.

“When I purchased it, the zoning changes had not been approved, but in the past few months I’ve received great news that zoning changes have gone through and I can now fit two dwellings on the corner block,” she says.

Patricia entered the Forrestfield market at a good time, as the suburb has been going through a major infrastructure upgrade. “Forrestfield is currently going through a massive revitalisation – the state and federal governments have injected $1.86bn into the Forrestfield Airport Link project,” she says. Patricia’s newest purchase, a property in Como bought in 2015, has been her most recent success.

“I purchased it at $450,000 and within a year had it valued at $480,000 – in a trying Perth market where prices were stagnating or decreasing,” she says.

Patricia has been in the property game for over 10 years now and continues to focus on acquiring and keeping as many properties as she can to avoid missing out on capital gains. At this point, she certainly seems to be meeting her goals, as the value of the assets in her current portfolio comes in at roughly $2.19m.

.jpg)

A strong close

Patricia is still paying off the loans on her properties, but she has high hopes for the next steps in her investment journey. “The first milestone of reaching $2m in total asset value when I purchased my latest property was really exciting,” she says.

“The first renovation I did – on my Dianella property – was a great learning experience as well. I realised that I love being hands-on and would happily jump into another reno project.” With profit being her main goal, Patricia does not intend to limit herself to residential property.

“Maybe one day I’ll veer off the well-known path and dip my toes in commercial or interstate property,” she says.

“I’d like to explore developments as well, as I have two blocks that are zoned to hold two dwellings each. I’ve renovated in the past, and that was a very exciting journey; I wouldn’t mind doing more of those.” Patricia’s end goal is to eventually fund her own retirement with her earnings as an investor.

“I’m relying on capital growth and negative gearing to get through to retirement. I’m not sure what the future will look like when I reach retirement age, but I know that I’d like to self-fund my retirement rather than rely on the government to do so,”she says. “I think that will relieve the pressure on the government to look after an ageing population.”

PATRICIA’S TOP 4 PROPERTY INVESTMENT TIPS

1. Know where the state houses are

Ask the agent if homes located in the area are state housing, as this could affect property prices.

2. Check the vacancy rate in the suburb

Ultimately those vacant homes in the area will be your competition when you come to lease your property out.

3. Bank on your deposit

Having a strong deposit, and finance terms of less than 80%, with 14 days’ approval and a quick settlement, allows you to negotiate.

4. Understand strata quirks

If the property is strata, make sure you get a firm understanding of what kind of strata.